FMP

The Significance of Terminal Value in DCF Valuation

Dec 19, 2023 11:00 AM - Parth Sanghvi

Image credit: NORTHFOLK

Introduction:

In Discounted Cash Flow (DCF) valuation, the terminal value estimation holds significant importance, representing a substantial portion of the total enterprise value. This article delves into understanding the concept of terminal value, its calculation methods, and its pivotal role in determining the intrinsic value of an investment.

Terminal Value in DCF Analysis:

1. Definition: Terminal value denotes the value of a project or an asset at a specific future point, beyond the explicit forecast period in a DCF analysis.

2. Importance: It captures the value of a business beyond the explicit forecast period, which often contributes significantly to the overall enterprise valuation.

3. Calculation Methods: Commonly, two approaches are employed to calculate terminal value: the perpetuity growth method (Gordon Growth Model) and the exit multiple method.

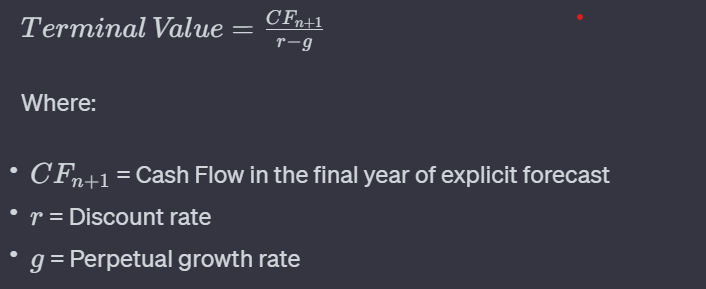

Gordon Growth Model:

The Gordon Growth Model assumes a constant growth rate indefinitely into the future, expressed as:

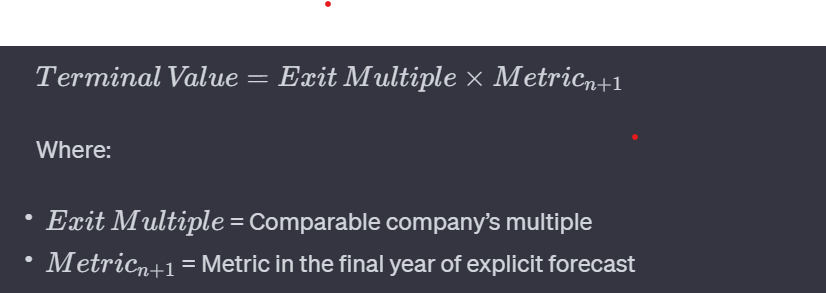

Exit Multiple Method:

The Exit Multiple Method estimates terminal value by applying a comparable company's multiple to a financial metric (e.g., EBITDA, Earnings) of the subject company:

Importance of Terminal Value in Investment Valuation:

1. Extended Forecast Horizon: Terminal value extends the valuation horizon beyond the explicit forecast period, capturing the business's perpetual cash flow-generating potential.

2. Significance in Valuation: Often, the terminal value accounts for a substantial proportion of the total enterprise value in DCF analysis, significantly influencing the final valuation.

3. Sensitivity Analysis: Given its impact on valuation, terminal value estimates are subject to sensitivity analysis to evaluate the robustness of valuation under varying scenarios.

Conclusion:

The terminal value estimation in DCF analysis is a critical component influencing the overall intrinsic value of an investment. Accurate calculation and understanding of this value are essential for investors and financial analysts, as it determines a significant portion of the projected future cash flows and plays a pivotal role in investment decision-making.

Other Blogs

Sep 11, 2023 1:38 PM - Rajnish Katharotiya

P/E Ratios Using Normalized Earnings

Price to Earnings is one of the key metrics use to value companies using multiples. The P/E ratio and other multiples are relative valuation metrics and they cannot be looked at in isolation. One of the problems with the P/E metric is the fact that if we are in the peak of a business cycle, earni...

Sep 11, 2023 1:49 PM - Rajnish Katharotiya

What is Price To Earnings Ratio and How to Calculate it using Python

Price-to-Earnings ratio is a relative valuation tool. It is used by investors to find great companies at low prices. In this post, we will build a Python script to calculate Price Earnings Ratio for comparable companies. Photo by Skitterphoto on Pexels Price Earnings Ratio and Comparable Compa...

Oct 17, 2023 3:09 PM - Davit Kirakosyan

VMware Stock Drops 12% as China May Hold Up the Broadcom Acquisition

Shares of VMware (NYSE:VMW) witnessed a sharp drop of 12% intra-day today due to rising concerns about China's review of the company's significant sale deal to Broadcom. Consequently, Broadcom's shares also saw a dip of around 4%. Even though there aren’t any apparent problems with the proposed solu...